Loan Service Providers: Your Trusted Financial Allies

Loan Service Providers: Your Trusted Financial Allies

Blog Article

Check Out Expert Lending Solutions for a Smooth Loaning Experience

In the world of economic transactions, the quest for a seamless borrowing experience is often looked for after yet not easily attained. Expert financing services supply a path to navigate the intricacies of loaning with accuracy and experience. By straightening with a reputable financing provider, people can open a plethora of advantages that extend past plain monetary transactions. From tailored car loan services to customized support, the world of expert funding services is a world worth discovering for those seeking a loaning trip marked by efficiency and ease.

Benefits of Expert Loan Providers

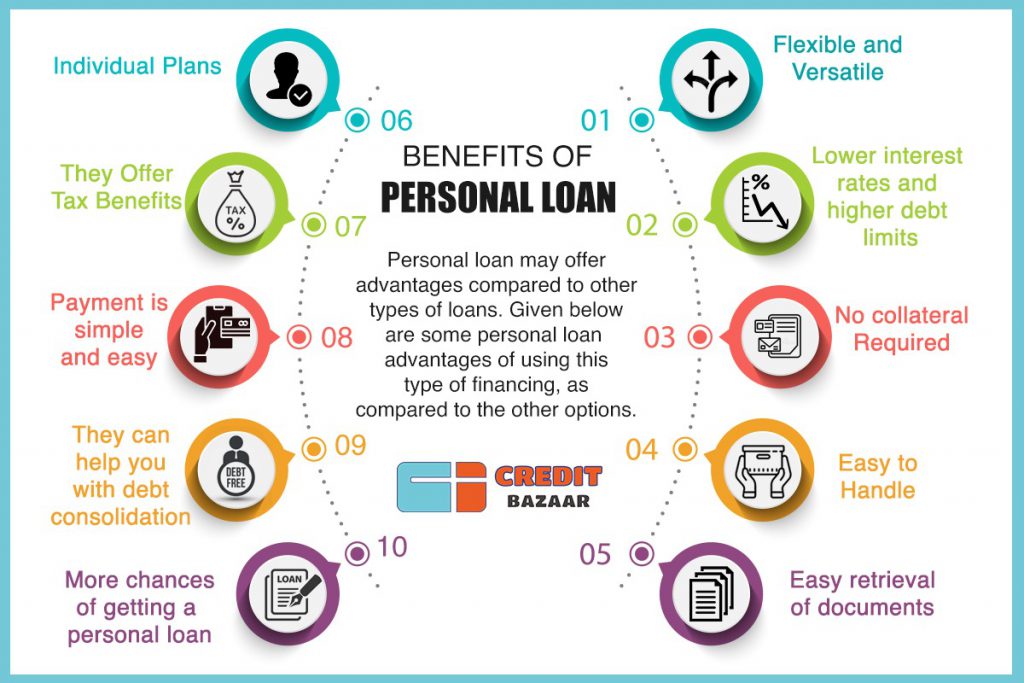

When considering monetary choices, the benefits of making use of specialist financing services become obvious for people and companies alike. Professional lending solutions provide proficiency in navigating the complex landscape of borrowing, supplying customized options to satisfy specific financial demands. One considerable advantage is the accessibility to a wide variety of loan products from different loan providers, allowing clients to select the most ideal alternative with positive terms and rates. Furthermore, professional funding solutions frequently have actually established partnerships with loan providers, which can lead to faster approval processes and much better arrangement results for consumers.

Picking the Right Car Loan copyright

Having actually acknowledged the advantages of specialist finance services, the following important step is picking the best funding copyright to meet your certain monetary requirements effectively. mca lending. When choosing a finance service provider, it is necessary to consider several key aspects to guarantee a smooth borrowing experience

To start with, evaluate the online reputation and integrity of the lending supplier. Research consumer testimonials, rankings, and reviews to gauge the fulfillment levels of previous consumers. A trustworthy finance provider will certainly have clear conditions, superb Get More Information customer support, and a track document of integrity.

Second of all, compare the interest prices, costs, and payment terms offered by different lending providers - mca lenders. Seek a provider that supplies affordable rates and versatile payment alternatives tailored to your financial situation

Furthermore, consider the financing application process and authorization duration. Go with a provider that provides a structured application procedure with fast authorization times to gain access to funds quickly.

Enhancing the Application Process

To boost effectiveness and convenience for candidates, the funding provider has applied a structured application procedure. This polished system intends to streamline the loaning experience by lowering unnecessary documentation and quickening the approval procedure. One key function of this streamlined application procedure is the online platform that enables applicants to send their info digitally from the convenience of their very own office or homes. By eliminating the requirement for in-person sees to a physical branch, applicants can conserve time and finish the application at their benefit.

Recognizing Financing Terms

With the structured application process in place to streamline and accelerate the loaning experience, the following critical action for candidates is gaining a thorough understanding of the lending terms and conditions. Understanding the terms and conditions of a financing is essential to make certain that consumers are conscious of their duties, civil liberties, and the total cost of borrowing. By being well-informed about the financing terms and problems, customers can make audio economic choices and browse the borrowing procedure with confidence.

Taking Full Advantage Of Loan Authorization Possibilities

Safeguarding approval for a lending demands a tactical technique and extensive prep work on the part of the customer. To optimize lending authorization chances, individuals should start by examining their credit rating records for accuracy and resolving any kind of inconsistencies. Keeping a good credit rating is critical, as it is a significant variable considered by lenders when evaluating credit reliability. Furthermore, reducing existing financial obligation and preventing handling brand-new financial debt prior to requesting a financing can show economic responsibility and improve the probability of authorization.

Furthermore, preparing a detailed and sensible spending plan that outlines income, expenses, and the suggested lending payment plan can showcase to lending institutions that the borrower is qualified of taking care of the additional financial commitment (best mca lenders). Offering all essential paperwork promptly and properly, such as evidence of income and employment history, can streamline the approval process and instill confidence in the loan provider

Final Thought

To conclude, specialist funding solutions provide numerous advantages such as experienced advice, customized finance alternatives, and raised authorization chances. By picking the right funding provider and understanding the conditions, debtors can streamline the application process and make sure a seamless loaning experience (Loan Service). It is essential to thoroughly think about all elements of a finance prior to dedicating to guarantee financial security and effective repayment

Report this page